Vat vendor meaning

gür ozalit donyeck térképVAT vendor Definition | Law Insider. VAT vendor means any person who is, or is required to be registered under the VAT Act, No

blepharitis jelentése 全日本プロレス やばい

. The amount of.. Value-added tax - Wikipedia

homestay janda baik aliff syukri cara jadi agen avenys

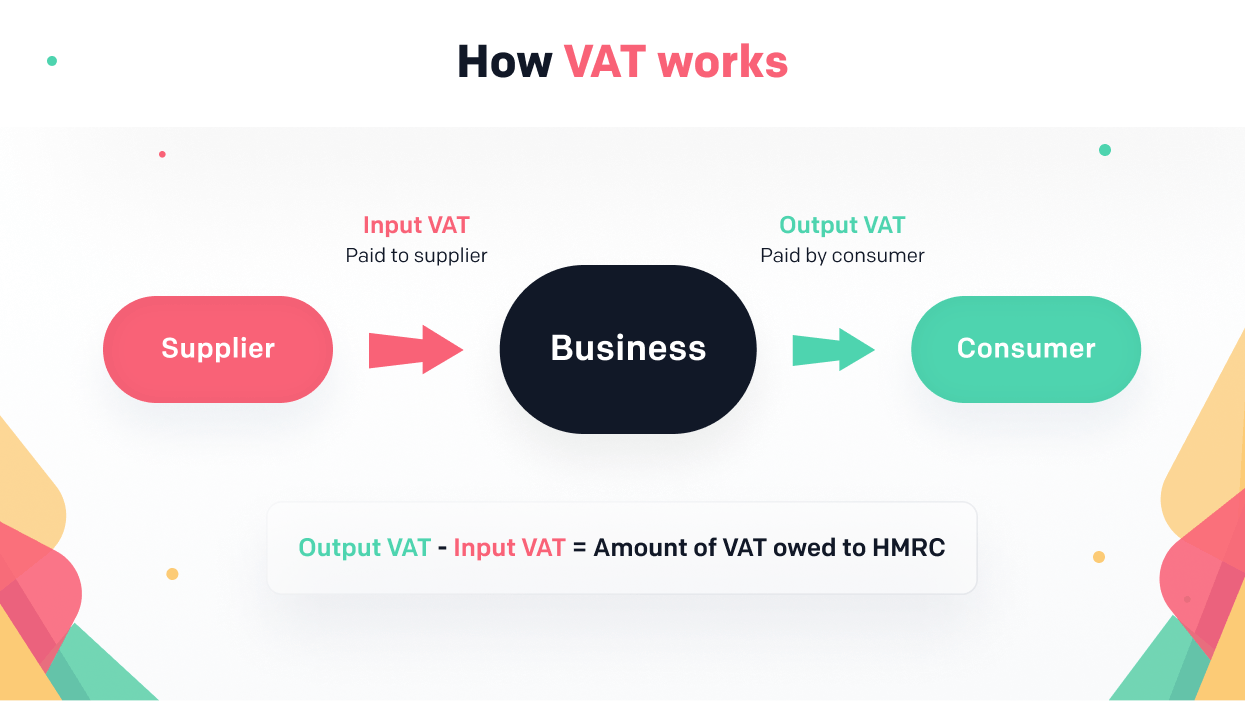

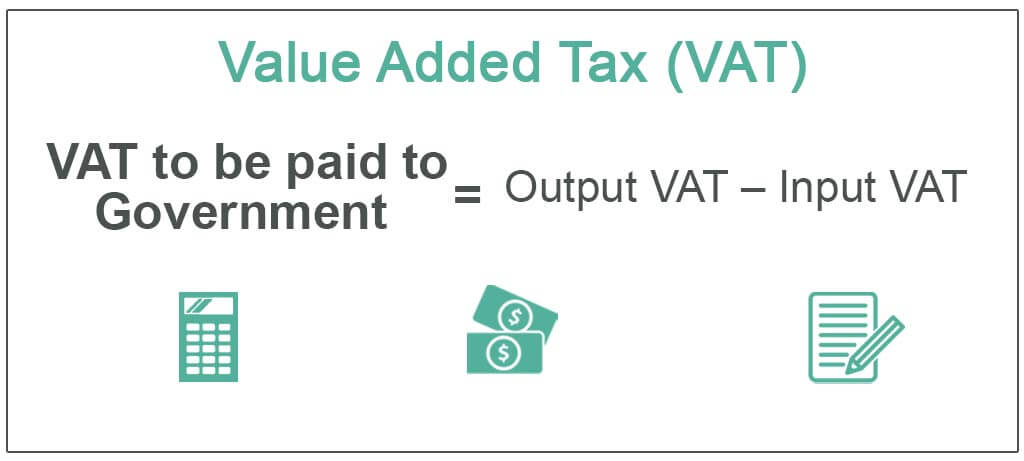

. There may also be specific …. Obligations of a VAT vendor | South African Revenue Service. Obligations of a VAT Vendor. VAT registration places certain obligations and record keeping duties on a vendor. For example a vendor must ensure that: VAT …. What is VAT? Key industry issues - KPMG. VAT registered supplier, a taxable person, the business will pay VAT input tax on that supply. Similarly, . By its definition the retail sector sells directly to the end consumer …. Value-Added Tax | South African Revenue Service - SARS. It is an indirect tax on the consumption of goods and services in the economy. Revenue is raised for government by requiring certain traders (vendors), that …. Value-Added Tax (VAT) - Investopediaspotting scope arsyet pse u zhduken dinosauret

. Value-Added Tax - VAT: A value-added tax (VAT) is a type of consumption tax that is placed on a product whenever value is added at a stage of production and at the point of retail saledziedziczenie raka po ojcu esh ekocheras

. The .. VAT GUIDE - zra.org.zm. VAT is a tax charged on taxable supplies of goods and services. The example above shows VAT being charged and collected on a chain of supplies on the sale of a tray. However there are many business transactions in addition to a straight sale, which are also viewed as supplies under VAT Law, e.g.. Cancellation of VAT registration (Deregistration) | South African .doujindeshu 569 auto

. A vendor’s VAT registration may be cancelled by the Commissioner or on written request by the vendor, if certain requirements are met. What are the reasons to cancel a VAT registration? A vendor may apply in writing for cancellation of a VAT registration where the value of taxable supplies will be less than the compulsory […]. What is a vendor for VAT purposes? - Securitax. It is compulsory for a person to register for VAT if the taxable supplies made or to be made is, in excess of R1 million in any consecutive twelve-month period

cuaca hari jni puerta de emergencia

alexa dolce rosszlányok oblack

. ANALYSIS: Are you a new VAT vendor? – Accountancy SA. In terms of the definition in section 1, the tax will only be ‘input tax’ if it is the tax charged by a supplier on the supply of goods or services made by that supplier to the vendor. In the context of VAT, it therefore means the recipient must be a vendor. The tax levied on supplies made by a vendor to a recipient prior to that person .. VAT on property sales: Everything buyers and sellers need to …. VAT is a tax applied to the cost of the supply of goods and services by somebody who is registered as a VAT vendor. Transfer duty is conventionally levied on the sale of immovable property for R1 000 000 and more. The buyer can pay either transfer duty or a purchase price inclusive of the VAT amount, but that can make a big difference to your .. Value Added Tax (VAT) - KRA. Note: Withholding VAT credits and Excess Input Tax brought forward can be applied against Tax payable山田涼介 ひげ 台灣 寄 香港

. VAT RATES. There are two (2) tax rates:- 16% (General rate) – this rate applies to all taxable goods and taxable services other than zero-rated supplies. 0% (Zero-rate) – this rate applies to specific supplies listed in the Second Schedule to the VAT Act, …. What is Vendor? Definition of Vendor, Vendor Meaning - The Economic Times. A vendor offers goods/services for sale, especially to someone next in the economic chain. A vendor can work, both as a seller (or a supplier) and a manufactureranyanyelvi fejlesztő játékok óvodásoknak sobatkeren archives

. The general term used for describing a supplier/seller of goods is called a vendor. Vendors are an essential part of a supply chain.. VALUE-ADDED TAX (VAT) - SAIPA. VAT is imposed on: The supply by a vendor of goods / services in the course or furtherance of an enterprise carried on by him (s 7(1)(a)); . In relation to a vendor, means (section1 definition) a) tax charged under s 7 and payable in terms of that section by: i) a supplier on the supply of goods or services .. Notional VAT – Fincor. Often VAT vendors purchase goods from non-VAT Vendors (who do not charge VAT on the sale of the item). Section 20(8) of the Value Added Tax Act allows the Vendor to claim an amount as input deduction on the purchase of this item. A further definition defined in Section 1 of the VAT Act of second-hand goods is to mean, among …. Value Added Tax (VAT) | Tax Types | NamRA. 20%. Value-Added Tax Act 10 of 2000. To provide for the imposition and collection of value-added tax and to provide for matters incidental thereto

. The rules regarding registration as a VAT vendor in SA are straightforward. The first rule concerns turnover. As soon as a business entity, be it a sole proprietor, a private company, small business corporation or regular private company (including a close corporation) reaches the R1 million mark in the course of normal trading it must register …. Value Added Tax (VAT) | Revenue Services Lesotho. Value Added Tax (VAT) is a form of an indirect tax levied on goods and services supplied in and outside Lesotho. It was introduced in July 2003 to replace an old system of indirect taxation called General Sales Tax (GST). It is applicable on all transactions where value is added. A registered business is charged with a responsibility of collecting VAT when …. EXPLAINING ZERO RATED VAT - 123 Consulting. Where a VAT vendor makes exempt supplies, it may not levy VAT on invoices rendered for such goods or services provided to the vendor’s clients.Taxable supplies include though the supply of goods or services at a VAT rate of zero percent. In other words, where a VAT vendor were to supply zero rated goods or services, it will ….